(410) 575-1118

info@letsdotax.com

Call to schedule a free no obligation initial consultation!

Call us today

(410) 575-1118

(410) 575-1118

LetsDoTax.com

LetsDoTax@2017

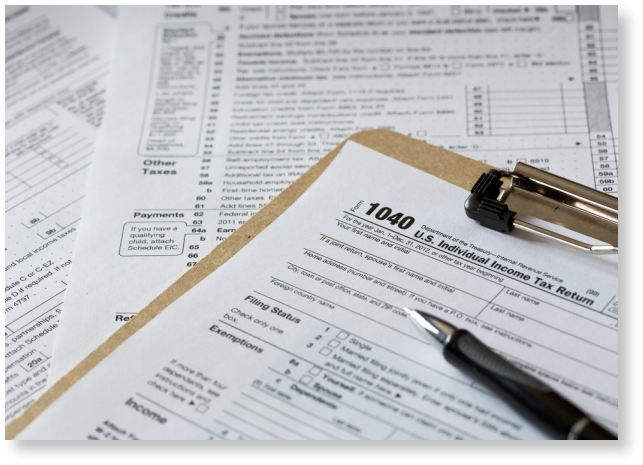

IRS Tax Form 1040 (U.S. Individual Income Tax Return) Form 1040 is the standard federal income tax form used to report an individual's gross income (e.g., money, goods, property, and services). It is also known as “the long form” because it is more extensive than the shorter 1040A and 1040EZ Tax Forms.

The 1040 Form is generally due by April 15th, unless you apply for an automatic tax extension. If you do not file by this date, you will be subject to penalties and/or late fees. You can request a tax extension by submitting IRS Tax Form 4868 by the original filing deadline (April 15).

There are many different ways to obtain Tax Form 1040. The fastest and most convenient option is to download the tax form on your computer. Additionally, most post offices and local libraries carry tax forms during filing season, and forms can also be picked up from a tax center or an IRS office. In addition, you may request a tax form to be sent to you from the IRS by U.S. Mail.

The 1040 Form is generally due by April 15th, unless you apply for an automatic tax extension. If you do not file by this date, you will be subject to penalties and/or late fees. You can request a tax extension by submitting IRS Tax Form 4868 by the original filing deadline (April 15).

There are many different ways to obtain Tax Form 1040. The fastest and most convenient option is to download the tax form on your computer. Additionally, most post offices and local libraries carry tax forms during filing season, and forms can also be picked up from a tax center or an IRS office. In addition, you may request a tax form to be sent to you from the IRS by U.S. Mail.

For Individual Taxpayers, you need form 1040 to file your returns. What is 1040?

Did you know that there are many different types of individual income tax return forms?

You must use the tax form that corresponds with your particular situation and allows you to

claim the income, deductions, credits, etc. that apply to you.

The most common types of income tax returns include the following:

Form 1040 (U.S. Individual Income Tax Return) (a.k.a. “the long form)

Form 1040A (U.S. Individual Income Tax Return) (a.k.a. “the short form)

Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

Form 1040NR (U.S. Nonresident Alien Income Tax Return)

Form 1040NR-EZ (U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents)

Remember that IRS Tax Form 1040, with payment, is due by April 15th. A 6-month tax extension may be granted (with IRS Tax Form 4868) for late filing, but payments must still be made by April 15th. You may file Form 1040 by paper mail, by using IRS e-file, or through an approved tax preparer.

Filing taxes online is generally safer, faster, and easier ? and you will get your tax refund much sooner if you choose the Direct Deposit option. While there are several tax forms to choose from when filing your federal income taxes, a safe bet is to use IRS Form 1040 if you are unsure whether or not you qualify for the 1040A or 1040EZ.

You must use the tax form that corresponds with your particular situation and allows you to

claim the income, deductions, credits, etc. that apply to you.

The most common types of income tax returns include the following:

Form 1040 (U.S. Individual Income Tax Return) (a.k.a. “the long form)

Form 1040A (U.S. Individual Income Tax Return) (a.k.a. “the short form)

Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

Form 1040NR (U.S. Nonresident Alien Income Tax Return)

Form 1040NR-EZ (U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents)

Remember that IRS Tax Form 1040, with payment, is due by April 15th. A 6-month tax extension may be granted (with IRS Tax Form 4868) for late filing, but payments must still be made by April 15th. You may file Form 1040 by paper mail, by using IRS e-file, or through an approved tax preparer.

Filing taxes online is generally safer, faster, and easier ? and you will get your tax refund much sooner if you choose the Direct Deposit option. While there are several tax forms to choose from when filing your federal income taxes, a safe bet is to use IRS Form 1040 if you are unsure whether or not you qualify for the 1040A or 1040EZ.

State Income Taxes

The income tax laws of the District of Columbia, Maryland, and Virginia (referred to as the tri-state area) in some ways parallel and in some ways diverge from Federal laws. You may wish to consult the instruction booklets for the state returns that apply to you and contact state taxpayer assistance help lines for more detailed information. This section will provide a general overview of state taxes.

In general, international students whose income exceeds the allowable standard deduction and exemptions for their state of residence may be required to file a state income tax return. Specific information relating to state taxation in our tri-state area is provided below.

In general, international students whose income exceeds the allowable standard deduction and exemptions for their state of residence may be required to file a state income tax return. Specific information relating to state taxation in our tri-state area is provided below.

MARIA LOURDES L. FILOTEO, CPA & ASSOCIATES, LLC

EIN:82-1276575

EIN:82-1276575

Set up an appointment today

Call Us at (410) 575-1118

Fax: 1-800-539-0233

eMail us at: info@LetsDoTax.com

Call Us at (410) 575-1118

Fax: 1-800-539-0233

eMail us at: info@LetsDoTax.com

FOR INDIVIDUAL & BUSINESS TAX RETURNS

INCLUDING NON-PROFITS

Let your taxes be done right by a CPA.

We are here to serve you at a reasonable cost.

Services: Tax Preparation for Individuals and Businesses,

Tax Forms : 1040s, 1120S, 1120, 1065, and 990s, including amendments.

Tax Tools: TaxWise, Pro Connect, Pro Series and a few Drake.

Prepared business taxes forms 1120, 1120-S, 1065 such as the following

industries: Marketing company, Real Estate, Airbnb’s, Government

Contractors, Home Repairs, Nursing Homes, Online Training center,

Sleep center, Staffing Agencies, Merchandising Sales, Transportation

business, Lending company, Medical offices, Martial Arts Gym, Restaurants,

Retailers, Online Marketing and more.

Prepared non-profit taxes form 990s for Animal rescue organization, Youth

Development, Food banks, Skills training center and more.

Tax Forms : 1040s, 1120S, 1120, 1065, and 990s, including amendments.

Tax Tools: TaxWise, Pro Connect, Pro Series and a few Drake.

Prepared business taxes forms 1120, 1120-S, 1065 such as the following

industries: Marketing company, Real Estate, Airbnb’s, Government

Contractors, Home Repairs, Nursing Homes, Online Training center,

Sleep center, Staffing Agencies, Merchandising Sales, Transportation

business, Lending company, Medical offices, Martial Arts Gym, Restaurants,

Retailers, Online Marketing and more.

Prepared non-profit taxes form 990s for Animal rescue organization, Youth

Development, Food banks, Skills training center and more.

We are located at :

1125 West Street, Suite 329

Annapolis, MD 21401

1125 West Street, Suite 329

Annapolis, MD 21401